On 7 December 2020, the Supreme Court started its final hearing on the long-drawn legal feud between Tata Sons and Cyrus Mistry. Cyrus Mistry is the Managing Director of the Shapoorji Pallonji (SP) Group that holds around 18% stake in Tata Sons. The forthcoming court judgement would decide whether Mistry should stay on Tata group’s Board or should the company be allowed to buy out SP Group’s stake. But first, let us understand what underlies this issue.

Context

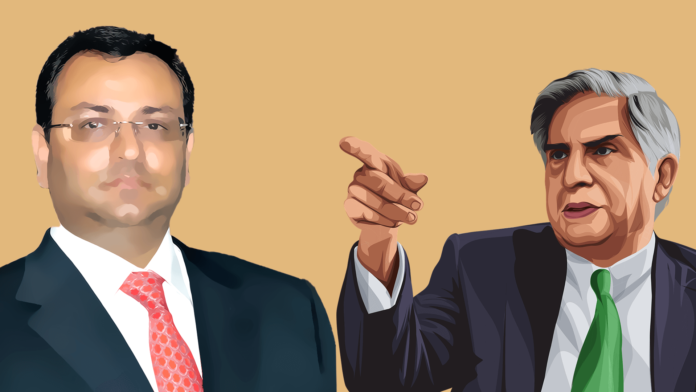

It all began in May 2016 when the Tata Sons ousted Cyrus Mistry as Chairman and Managing Director of Tata Consultancy Services, Tata Teleservices, and Tata Industries. About four years earlier in April 2012, Ratan Tata had appointed Mistry as his heir after having helmed the Tata group for over two decades. But soon, tensions started to rise between the two parties, Mistry was expelled, and Ratan Tata took over as Chairman Emeritus.

After that, began a series of appeals to the Court. Mistry filed a court case against Ratan Tata and the company. He alleged that his removal was illegal as it was done without completing the procedure necessary under law. He also felt that his ejection from the Tata Board was not justified. But the National Company Law Tribunal (NCLT) rejected his initial petition. He challenged this judgment in the National Company Law Appellate Tribunal (NCLAT). And this time, the NCLAT responded in his favour. The bench issued a scathing 172-page judgement against the Tata Board in December 2019, calling for the reinstatement of Cyrus Mistry as the Executive Chairman & Director of the companies he was removed from. Both sides are now determined to fight again in the Supreme Court as a bench headed by CJI SA Bobde is set to give its final verdict in 2021.

Mistry’s expulsion unethical:

Many media articles referred to Cyrus Mistry’s exit as India’s biggest boardroom coup. Mistry argued that Tata Sons did not follow the due process for removal of the Chairman, which is prescribed under Article 118 of its Articles of Association. The NCLAT bench also reaffirmed his mistreatment, viewing this case as an assault on minority shareholders’ rights. As Justice SJ Mukhopadhyaya said, “The Articles of Association became Articles of Oppression.”

Besides, there was another concern: Should a tax-exempt body like Tata Trusts be allowed to hold equity shares in a Public Limited Company like Tata Sons? After Mistry’s exit, Tata Sons became a private company to enjoy relaxed governance standards. And the judges took notice once again. The bench directed the Registrar of Companies to reconvert Tata Sons, noting the rampant misconduct on part of Ratan Tata and the Board.

Cyrus Mistry’s counsel is now arguing that the long-standing relationship between Tata Sons and SP Group is not purely commercial but based on trust and confidence. Their cordial relations have extended to marital ties with Cyrus’s sister being married to Noel Tata, who is Ratan Tata’s half-brother. So, there is a legitimate expectation of being treated in a just and fair manner. Even if Mistry is no longer the executive chairman, he deserves his place on the Board.

How will this help the SP Group? They would be able to raise capital against their shares and further separate from the Tata Group. “A separation is necessary due to the potential impact this litigation could have on the economy and livelihoods,” reads one of their recent statements.

Majority shareholders’ decision valid:

“The Tribunal held Ratan Tata guilty without any factual or legal foundation,” said Tata’s petition. Cyrus Mistry’s dismissal was valid because Tata Trusts have a majority stake in the conglomerate. For some more background, the Sharpoojis became Tata shareholders back in 1965, and 15 years later, they got a seat on the Board. Then in 2004, Sr Pallonji exited the Board while Cyrus Mistry was invited to join in 2006. Ratan Tata’s lawyers have argued that Tata Trusts still hold 66% shareholding in Tata Sons. So, it is well within their right to nominate anyone on their Board and refuse any transfer of their shares.

The initial NCLT order had noted similarly: The Board and its majority shareholders had “lost confidence” in Mistry and their decision to remove him was “competent.” Moreover, the NCLAT’s 2019 order for Mistry’s reappointment was uncalled for as he had not asked to be the group Chairman in the first place. “I have no intention of running Tata companies, but I definitely want my rightful place on the Board,” he had said.

Tata doesn’t want to give him the privilege of returning to the board either. His lawyers maintain that Mistry has no automatic place on the board just because of his shareholding. The company’s Articles of Association (the rules of governance) clearly state that its board can pass a special resolution, asking any shareholder to sell their holdings. So, they will be merely exercising their rightful power by buying the SP Group out. This way, they will also be able to prevent Mistry from pledging the shares and carry on their business as they wish. They have already offered to buy shares in SP Group’s holding companies and aid their fundraising efforts.